David Crisp, chief executive of Bodmin-based Orecon, has a grand plan to turn Cornwall into the Silicon Valley ofthe global wave energy industry.Crisp’s career has taken him around the world, from the oil and gas industry in the North Sea to the original Silicon Valley in California itself. He also has an enviable track record with start up companies, taking them to the pinnacles of success.And this experience working with venture capitalists means he knows a good idea when he sees one, which is exactly what happened when he first came across fledgling wave energy company Orecon.Now armed with significant VC backing, he aims to make Orecon a global leader in this embryonic industry, which is estimated to be worth up to £160 billion. Crisp talks about his time before Orecon, sailing across the Atlantic into Fowey, and how environmental technologies like wave power represent the world’s economic future.

David Crisp, chief executive of Bodmin-based Orecon, has a grand plan to turn Cornwall into the Silicon Valley ofthe global wave energy industry.Crisp’s career has taken him around the world, from the oil and gas industry in the North Sea to the original Silicon Valley in California itself. He also has an enviable track record with start up companies, taking them to the pinnacles of success.And this experience working with venture capitalists means he knows a good idea when he sees one, which is exactly what happened when he first came across fledgling wave energy company Orecon.Now armed with significant VC backing, he aims to make Orecon a global leader in this embryonic industry, which is estimated to be worth up to £160 billion. Crisp talks about his time before Orecon, sailing across the Atlantic into Fowey, and how environmental technologies like wave power represent the world’s economic future.

Business Cornwall: Before we get into wave energy and Orecon, I understand that you started out life in the oil and gas industry?

David Crisp: Yes, I spent 10 years with Schlumberger, a French/ American company. Basically it’s a high tech company surveyingtechniques into the oil industry, surveying the oil wells. When you drill a hole, you need to find out if you’ve got oil, and if so, how much. I joined them from university and worked primarily offshore.Everybody at Schlumberger starts as a field engineer and you work your way up the tree. So I started off working in the North Sea, first of all in Holland, then in Aberdeen and then moved upthe line management pretty fast really, taking me to the Far East.Ultimately I left Schlumberger I raised venture capital funding formy first start up.

BC: And that was the Eden Group? What did that involve?

DC: We were doing mobile, hand held devices, and specifically the embedded operating system.BC: So quite different from the oil and gas industry.

DC: Very. I got involved with high tech within Schlumberger after ten years or whatever it was in the offshore oil and gas industry. I couldn’t keep moving around frankly for family reasons, so Imoved into their high tech division where they were making a lot of acquisitions and that’s where I learned you don’t have to have a 95% market share to make money. And there I got very interestedby high technology, computers and whatnot. So working for Schlumberger really taught me what it’s like outthere, and what’s involved taking technology offshore. And it’s a pretty rigorous environment.

BC: So a good grounding then?

DC: Yes. I’ve always been a keen sailor but the oil industry pretty much does everything from heavy engineering through to pretty sophisticated technology in a hostile environment, and that gave me an excellent grounding in appreciating that if you want to take something offshore and for it to have a high reliability and basicallybe an unmanned system, then it needs to be as simple as possible – minimum moving parts. That is part of the driving forceof Orecon and the other guys who work here have equally worked offshore and have the same view.

BC: You sold Eden to investors in California and joined a venture capital fund there. How many years were you in California for?

DC: Five in all. I joined a VC firm as entrepreneur in residence, looking at stuff that came through the door with the ultimate intent that I would leave and move onto one of them. I had greatfun doing that for a few months before I got headhunted to run a new start up, a corporate spin out called Neopost online. Neopost is a pretty large international corporation doing mail handlingsystems and they have some very interesting technology in-house. They wanted a spin out, the chief exec and chairman was an exmanager of mine, so he got in contact and persuaded me to gothere and start from scratch with this new start up.

BC: And this was in about 2000?

DC: Must have been about then. And I ran it for two years, we literally took it from two people to about 200 and developed the business, made an acquisition, and took it to $25 million revenues.But then the dot.com bubble burst, our growth rate flattened out, so we decided to shut down a bit of it and roll the rest back into the corporate parent. I decided at that point to leaverather than go back into the corporate life, so I took two years off to go sailing.

BC: You’re a keen sailor I take it?

DC: Yes. I had always wanted to sail the Atlantic, so I bought a boat in France, and with my wife, daughter and son, sailed it over to the Caribbean, and then sailed it back home to Fowey! My bigambition had always been to sail into Fowey transatlantic, straight in on full sail, and I did it!

BC: So that take us up to present day more or less, how didOrecon come about and what attracted you about it?

DC: I came across Orecon at a drinks party. I was talking to a guy who was a non exec director and it just made a lot of sense.

BC: It originates from Plymouth University doesn’t it?

DC: Fraser Johnson, the core founder, had been in the Merchant Navy for about ten years, went back to Plymouth to do a degree in marine engineering and that is where we kind of came across the concept. He and Nicky Meek explored it at university and ultimately spun it out and formed Orecon. They developed the technology using Carbon Trust and Dti funding, but ran out ofmoney and kind of went dormant. Then I happened along and it just made a lot of sense. It was alot of things, technologically it was elegantly simple. And based on from what I knew of offshore, it made sense to me. And the more I dug into the proposition, the more it made sense. Themarket opportunity was really clear, the whole renewable sector, there was a need for that. There was a personal thing in there aswell, as you get a bit older, I kept thinking to myself do I want to be pumping another x million plastic widgets into the world?

BC: Were you actively looking for a new project at the time?

DC: Yes, I was doing some work with Bristol University and one or two VC funds, so I was kind of looking. So I took hold of it, spoke to venture capitalist contacts I had, it was hard work, but wegot the funding.

BC: Going back to when you were at the VC firm in California, did similar type projects come before you then?

DC: Not really. Orecon was a big step for me in that up until that point I had been involved in high tech, so everything elseI had been looking at in the UK would have taken me up to London or Bristol. It was all internet based, or software typetechnologies. So Orecon was a bit of a leap, back into energy. I liked it in a way going back into the energy business, but it was a bit of a leap.What helped me make the jump is that I was pleasantly surprised by the reception I got from the venture capital firms. I have an open door with many of them and tentatively said, “I haven’tbecome a tree hugger, but what do your reckon?” and they were really positive.

BC: I often hear the phrase ‘ET’ and that it is going to be the next big thing. Not the alien film character, but environmental technology! Is this a new gold rush potentially?

DC: When I say I didn’t want them to think I had become a tree hugger, what I mean is that you do sometimes meet people whoare too simplistic or idealistic in their view of things. And what I saw in Orecon is an opportunity for a new kind of business, if youlike a third millennium business.

BC: What do you mean by third millennium business?

DC: I have a concern that in my lifetime alone, the population of this planet has doubled. Our consumption of raw materials hasgone up by more than that and you cannot maintain that. The world is a very finite place and the scale of what we are doing isbecoming significant in the context of the planet. There is an obsession and drive in society today that the economicsof a country and a company are driven by growth, and that just exacerbates the problem. We need to find new things to do tofinance our economic lives. What Orecon represents is a business that is harnessing what is basically an infinite supply of energy. It’sa renewable source of energy, it’s energy that we need in our lives, it’s a clean source. The work that we do is investing in something that is sustainable. The devices we deploy when they reach the end of their lifespanin 20, 25 years, are recyclable, can be melted down. I want to make a lot of money for Orecon and the investors – I want to go sailing again – but I hope that the wealth we create is sustainable, taking usin a more positive direction than just consumption. And at the same time we are creating economic benefit for what is a very poor partof the UK, and we are creating jobs, all without impacting on the countryside, it’s all offshore, and on top of that we believe with the technology we are using maybe we can help with the over fishingproblem by creating fish havens and eco systems. So to me it is really exciting that we are doing something that on one hand meets the capitalist agenda, and on the other handmeets the sustainable business type agenda.

BC: Do you think in the past some green ventures have been too naive about making money.

DC: I don’t think they’re naive at all. I think sometimes in the past, proponents of the green agenda don’t put their pitch across as well as they might. Rather than just telling people they are wrong you need to offer a solution they can work with. I’mworking with the ultimate capitalists, the venture capitalists, but harnessing a resource that I hope will be able to take us somewherepretty positive.BC: How is the current economic climate impacting? I know you secured £24 million earlier this year, how far will that takeyou up to?DC: That will finance us to build and deploy our first device and prove the technology.

BC: And is this still on schedule for 2010?

DC: Yes. But it’s hard to know how the economy will affect us, because the dust is still settling on the situation. Already I’m beginningto hear that the renewable/clean tech sector may be one of the strong sectors. I was listening to the radio the other night which was talking about Obama in the States, and saying withany luck if they are going to spend public money to stimulate the economy on projects, they will do it on renewable energy. If you do that you are cracking two nuts – you’re helping stimulate theeconomy and creating jobs and you’re actually investing in somewhere you need to. So I’m hoping that’s what will happen.BC: Have you had much Government financial assistance to date?DC: Before I joined, the company had a carbon trust grant, and in collaboration with some other companies, a BERR funded project,but 99% of the funding is coming from private investors.

BC: At the moment is all your time and energy going towards the demonstration buoy in 2010.

DC: Yes, step one has been to build the team and get the right people in place. We have ten full time people here now, and somesub contractors around the country.

BC: Has that recruitment process been completed now?

DC: We have the team we need for now, next year we’ll probably need to find a few more. What we are doing at the moment istaking previous designs to the next detailed level, ready for construction. Tank tests to verify the implementation of the design, ascertaining build costs etc. At the end of the day you’ve got toproduce power at an economic price. This year we’re focussed on developing the design ready for construction and providing we arehappy with the costs and everything else that comes out of that, we will move into construction next year.

BC: How difficult has it been persuading investors that this works when you haven’t got anything physical to show them?

DC: At this stage it’s not persuading people if it works, because you don’t know for sure. It’s about persuading people that it’s a proposition that is worth backing. What investors are looking for is fundamentally a proposition that they sense they can believein, and a team that can deliver that. And one of the strengths of Orecon has always been the proposition and secondly the people we’ve assembled around it, investors look at those guys and say Ican back those people. Investors invest in people as much as anything else. The team is what’s important.

BC: How is the wave energy industry globally? Is it still a very new industry?

DC: It is, if you like, commercially, a non-existent industry today. It’s where the wind power industry was 15, 20 years ago I guess. To date no one has deployed or proven a commercial device.About a month ago, a Scottish company, Pelamis, deployed three devices off Portugal. Come next spring we’ll know if that’s been successful or not, but until then nothing has been proven. In thatsense the market is wide open, but the market potential is vast.

BC: Roughly, how much is the market worth do you think?

DC: The Dti speak of a number, it’s quite a broad range of £90- £160 billion globally. I did an analysis of the UK, and they reckon in the UK wave energy can deliver something like 15% of energyneeds, so working back from that, I figure the industry is worth £1 billion to £2 billion a year, for the next 20, 30 years.

BC: How much does wind deliver? Are the potentials of the twocomparable?

DC: I think wind is forecast for 15%-20%, so the potential is similar. So it’s a £20 billion, £30 billion market, and that’s just buildingthe devices. If you then look at the ongoing operation of the devices, there is a revenue opportunity there as well.

BC: Are you looking to operate them as well, or just build them?

DC: Our business model is to build and sell them to power companies and to provide on-going support.

BC: And this is obviously around the world, but when you launch the demonstration buoy, will this be off the Cornish coast?

DC: I hope so, yes. We’ll make an announcement on that sometime in the New Year.

BC: And where is your involvement at concerning the Wave Hub project?

DC: We’re talking to SWRDA a lot about that. Last year, before Orecon was funded, they went out and selected four companies to allocate slots to on Wave Hub. Because of the delays that maychange, so we’re quite hopeful of getting a slot on Wave Hub.

BC: Why the delays at Wave Hub?

DC: I’m not sure, you’ll have to talk to them. But I think it’s the classic challenge of driving a project like that, and with public money as well, but there have been some project problems.

BC: Wave Hub is something you’d like to pursue but not centralto your plans?DC: Wave Hub would be great, we’d like to deploy there, but we’re also pursuing other options. Until we know we have a slot there, we are looking elsewhere as well. And all things being equal, wecould end up at Wave Hub and somewhere else.BC: What are the main challenges a project like yours faces?

DC: The fundamental issue is can you produce electricity at a price that is commercially viable? It is expensive building devicesto put offshore but the fuel is free. Unlike a conventional power station, like gas or coal, the capital investment is much higher, butdownstream you have no fuel costs. So the beauty is, once you’re deployed your price of power, costs, are fixed for the next 20 years.

BC: But I imagine the cost of building it is huge?

DC: It is. But one of the things we’re focused on, is by keeping the device simple, you keep the operating costs very low. It’s aboutmaintenance and reliability.

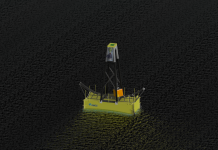

BC: In very layman’s terms, how does your device work?

DC: Orecon’s technology is called oscillating water column technology, OWC. If you take a milk bottle and chop the bottom off, put the bottom third or so of the bottle in the water, as a waveup compressed air gets pushed out of the neck of the bottle, as it goes down it gets sucked back in again. So you put a wind turbine in the neck of a bottle and producepower. It’s that simple. The buoy itself has got no moving parts in the actual floating buoy, it’s just a big floating buoy with threebig chambers in it. The only moving part is essentially a shaft, one end of it is the turbine, the other end is the generator, there’s no gearbox, and that’s on top of the buoy where it’s maintainable. Sothat’s the beauty of OWC, it’s a very simple technology, so we’re looking to have very high reliability, very low maintenance costs.Competitive technologies use hydraulics and rams and it’s much more complicated, but it’s just a different approach. Another challenge is storm survival. It’s a wicked world outthere, on the one hand you want the waves, on the other han they’re pretty destructive. So you’ve got to build a device that’s going to survive 20-25 years, through 100 ft waves, and that puts the costs up. Reliability has to be high, if it’s not working you’re notgenerating, so the challenge is to fit all those pieces together, making sure it survives, is reliable and produces relatively cheap power.

BC: How far out to sea will these devices go?

DC: It will vary, depending on sea floor conditions, but typically for Orecon we’re talking four or five miles out.BC: There have been concerns it will disrupt the surf.DC: First of all the amount of energy the devices are absorbing proportionately are not that great, so short of filling the oceanaround the UK with these things, I don’t think you’ll see any impact on the waves, but we are intending to do some research into this. As with anything when going into the unknown, people willbe concerned. But part of our philosophy is to look at these issueswith the interest groups concerned and either allay these fears orto see how we can take advantage of what we’re doing.

BC: You recently met Prince Andrew to discuss your plans, what did he have to say?

DC: I was impressed. Very knowledgeable, very incisive and very positive. He sees the opportunity and really got it. It’s a massive economic opportunity and today the UK leads the way in wavetechnology.

BC: It’s such a new industry, how competitive is it?

DC: There are a lot of companies out there scattered around the world, but the big proportion is in the UK. We have as yet to go through a process of thinning out, which will happen. But the UKhas the opportunity to lead this market if we take it, and I hopewe do.

BC: The demonstration device is set for 2010, when do you will be commercially operational and delivering power?

DC: The demonstration device will be on a commercial scale. Come 2011, if it’s operating fine, we’d expect to start constructing further devices. The power companies are really keen on this technology,and the minute they are happy it works, you can expect the orders to come thick and fast. And you can expect to see us building a lot more units in a 2013, 2014 timescale.

BC: What’s your long-term plan. You have a record of starting up companies and selling them on, is that the plan here?

DC: The nature of the investors is that they will be looking to cash in on their return in the next five to ten years, that’s what it’s about. Possibilities are we float on the stock market or potentiallybe acquired by another company. It could be an oil company, a power company, a marine engineering company – who knows. But at the moment our focus is that if we make the business successful,that will take care of itself.

BC: What can you deliver to Cornwall?

DC: In the long term Cornwall has the best wave climate in England and when you look at the whole of the UK, it’s basically the north coast of Cornwall and the Isles of Scilly, and western Scotland.What I want is for Orecon to be a leader in that domain and initiate a clustering of similar companies.

BC: Is this how it works in a new industry, a company becomes successful and others move into the area?

DC: Silicon Valley was, 30 years ago or so, just a fruit farming area.Then you got the likes of Apple and Intel and other companies start up there and one success breeds more. Our Silicon Valley in this country is Cambridge. You start off with some technologycompanies happening to be there, in this case the university. They produce people, wealth, and attract other companies to start up there. It’s a virtuous circle that slowly escalates and you get to acritical mass and away you go. If we can make Orecon a big success and wave energy in Cornwall a big success, then ultimately more and more people will come here to start up.My vision, way beyond my working life probably, is that Cornwall becomes the Silicon Valley equivalent of wave energy. Many years ago Cornwall exported mining technology and know-how globally. It would be great if the new Cornwall mining technology could be wave energy. It’s like Aberdeen is the centre of the UK oil industry because that’s where oil is, let’s have Cornwall being the centre ofthe wave industry, and if we move we can grab that market.

BC: Do you personally have a timescale how long you’ll be here?

DC: (laughs) No idea! First step is the company’s success, and if I’m still having a lot of fun, to keep going!